Explaining Earnings Reactions

With another set of quarterly earnings being reported, clients probably notice a lot of large stock moves in reaction to the news. Often the stock moves seem unrelated to the earnings news. Why did Apple and Facebook trade down after easily beating Wall Street estimates? Why did Alphabet trade up and Comcast trade up when they also beat estimates?

Beyond the old adage that “traders got to trade”, there are three things happening. First, investors adjust expectations right up until earnings are reported. The “whisper” estimate can often be far ahead of analyst estimates. This was the case for Facebook where blow out results from Alphabet, Snap, and Twitter had raised expectations such that the earnings beat the company reported was not a surprise and actually fell a little short of the whisper. Second, Wall Street is more concerned with the future than the past. This may be especially the case currently given the reopening of the economy seems to obviously suggest high earnings gains that will dissipate as time passes and pandemic’s economic impact recedes. Investors look to “guidance” provided by management about future quarters. Apple was an example this quarter as the company unexpectedly suggested that supply chain issues will slow the growth of iPhone sales over the balance of 2021. Apple had avoided the supply chain issues plaguing so many other companies. Third, how investors, especially traders are positioned heading into the earnings report impacts initial trading reactions. This aspect is a combination of the first two points. Traders can easily get caught too bullish or too bearish and be forced to quickly adjust positions.

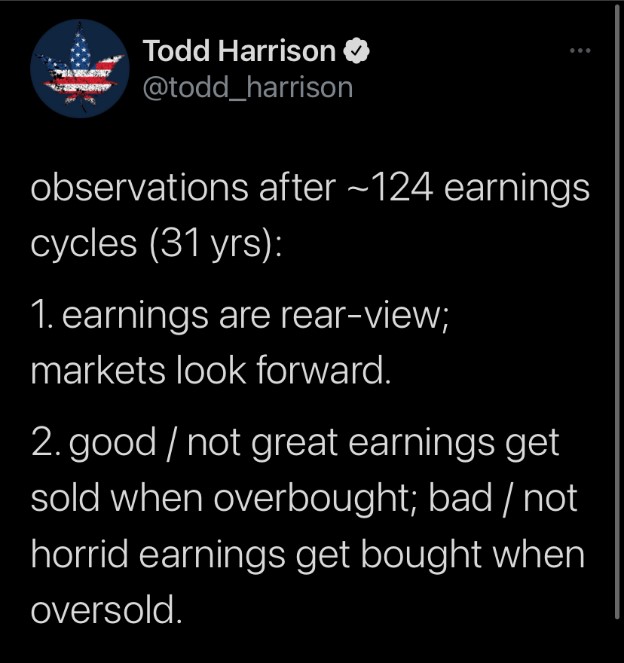

The earnings reaction game is summarized well by our friend and fellow money manager, Todd Harrison:

We agree with Todd and extend his timeline to 156 earnings cycles or 29 years!!!