Sticking with Mid Cap and Value into the Recovery

There are no changes to the recommendations from Northlake’s Market Cap and Style modes for May. We are sticking with Mid Cap and Value for another month. Current client positions following the models in the S&P 400 Mid Cap (MDY) and Russell 1000 Value (IWD) will be held for at least another month. Clients also gain exposure to these themes from investment in ETFs focused on financials, industrials, and small cap value ETFs. International ETFs are also a path to value exposure especially in developed markets like Europe where the COVID recovery is lagging the United States.

The key takeaway from our latest model update is that the value signal is the strongest it has been in 20 years and was also near this level in 2010. The models have been tweaked multiple times over these time frames, so the comparison is not perfect but clearly something unusual is happening in the growth vs. value debate.

Recently, we have discussed “rotation” a lot. To recap, the market has been moving regularly between growth and value, large cap and small cap, COVID winners and COVID losers, and cyclical and defensive. The changes have been choppy the last few months after a six month stretch ending in mid-February where small caps, value, COVID losers, and cyclicals performed very well.

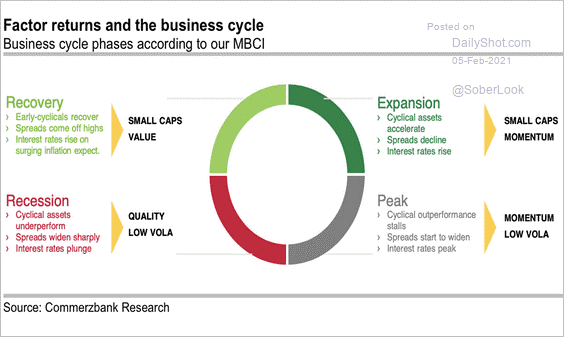

Northlake currently recommends mid cap and value. Taken together these areas capture most of the stocks that were market leaders from late last August through mid-February. We have been firmly of the opinion that these themes would reestablish and sustain leadership over the balance of 2021. A simple way to look at rotation and why we like our current positioning is this chart:

We are in the Recovery stage of the cycle now. The current recovery is likely to be turbo-charged by a combination of massive pent-up demand, extreme fiscal stimulus, and sustained highly accommodative monetary policy.

It is no coincidence that our Style model is flashing a similarly strong value reading as in 2010. In 2021 as in 2010, the economy is emerging from an unusually steep economic crisis. We have data on our models going back to 1979. There is a clear trend that the strongest value signals have occurred when the economy is exiting recession and is in the recovery phase.

We think the outlook is strongly in favor of small (and mid) cap and value stocks. These areas have struggled for ten years as the digital economy steadily gained coming out of the Great Recession and accelerated due to the unusual impact of COVID. The recent six month stretch of improved stock market performance for small and mid cap and value provided a nice catch-up move after a historic stretch of underperformance. Northlake believes there is plenty more to go even after adjusting for the changes in economic activity triggered by digital technologies.

MDY and IWD are widely held by clients of Northlake Capital Management, LLC, including in Steve Birenberg’s personal accounts. Steve is sole proprietor of Northlake, a registered investment advisor. Northlake’s regulatory filings can be found at www.sec.gov.