Models Shift as Market and Investor Assumptions Change

Our Market Cap and Style models shifted for August. Market Cap is now recommending mid cap, and Style moved to neutral. Both models had been on their prior recommendations since the beginning of February. The changes are due mostly to factors driven by the market’s sharp rebound in July that impacted the technical and trend indicators. Also contributing to the changes are further signs of slower economic growth. In a weak economic environment, growth themes often perform better since growth company earnings are less cyclical than value company earnings. Another influence is the downward move in intermediate and long-term interest rates. Growth stock valuations benefit from falling interest rates as a lower discount rate is applied to the long-term stream of earnings and cash flow. For more cyclical value stocks, lower interest rates can signal a decline in investor confidence about future economic growth, or as in the current case, fear of a recession. Finally, investors took a dovish view of the latest Federal Reserve interest rate increase after comments by Chairman Powell indicated the Fed could be closer to ending the current round of policy tightening. There has been great fear that the Fed’s inflation fight would go too far and contribute to a possible recession. This factor is particularly important to the shift from large cap to mid cap since mid cap stocks are more sensitive to future economic growth.

We find our models consistent with our own thinking about market and economic developments. As a result, client positions following the models will sell holdings in the S&P 500 (SPY) and half of holdings in the Russell 1000 Value (IWD). SPY proceeds will be reinvested in the S&P 400 Mid Cap (MDY). IWD proceeds will be reinvested in the Russell 1000 Growth (IWF).

Interest rates fell across the entire yield curve after the Federal Reserve raised the Federal Funds rate by three quarters of one percent last week. Even short-term rates that are most tightly linked to the Federal Funds rate declined slightly. A client asked if this was contradictory. Here is how we answered:

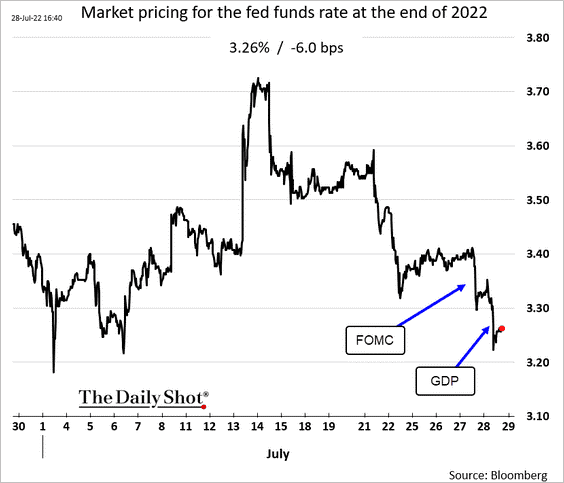

Financial markets discount the future. The Fed raised the Federal funds rate by 75 basis points to bring it up to 2.25-2.50%. Three-month Treasury bills were already yielding over 2.50% because the move was widely expected. When Powell spoke in his press conference, investors thought he was dovish, showing concern about not hurting the economy too much and indicating that the Fed was getting near its neutral rate. In response, the odds of another 75 bps at the September meeting dropped, as did investor expectations of the ultimate peak in the Federal Funds rate. Thus, market rates fell slightly to reflect this presumed new info. Here is a visual representation of market-based views of the future path of the Federal Funds rate that shows the shift lower in investor expectations after the FOMC meeting:

MDY, IWF, and IWD are widely held by clients of Northlake Capital Management, LLC, including in Steve Birenberg’s personal accounts. SPY is also held by Northlake clients. Steve is sole proprietor of Northlake, a registered investment advisor. Northlake’s regulatory filings can be found at www.sec.gov.

Leave a Reply

Want to join the discussion?Feel free to contribute!