Models, Strategies, and Ukraine Related Market Volatility

We are departing from our usual monthly blog update that focuses solely on our Market Cap and Style models and thematic strategies to provide our current thoughts on market volatility surrounding the Russian invasion of Ukraine and our decision thus far to sit tight and not make major changes to client portfolios.

March 2022 Model and Strategy Update

At the beginning of February, we shifted our preferences to large cap and value from mid cap and neutral after reviewing our models. We received our latest updates this morning and each model moved modestly further in favor of the new recommendations. Thus, current client accounts using our Market Cap and Style strategies will continue to hold positions in the S&P 500 (SPY) and the Russell 1000 Value (IWD). Client accounts using our thematic strategies but not our models continue to be overweight value and include an international component. International is facing incremental pressure relative to the U.S. due to the Russian invasion of Ukraine but we continue to see great value abroad after several years of severe underperformance vs. U.S. markets. International also provides diversification benefits.

Market Volatility and the Invasion of Ukraine

Given the historic market volatility and sharp correction, we want to offer some thoughts on the potential stock market impact from the Russian invasion of Ukraine. Most importantly, at this time, we expect market volatility to continue but we are sticking with the plan and making no major shifts in client account strategies.

Predicting what is going to happen in Ukraine seems impossible, and to be honest, it is beyond our knowledge base. We understand markets, but we are not experts in geopolitics and war. We can look back on prior crisis environments to see how the stock market has reacted, and do so below. It might surprise you that the history contains a lot more good news than bad news.

Before we get to that, we wanted to share a good summary of the unpredictability of what happens next from Jefferies strategist David Zervos. We always look forward to David’s notes and this week’s update proved no exception. This quote captures Northlake’s thoughts about the inability to make predictions:

“There could be escalation or de-escalation. There could be a complete destruction of Ukraine or an internal revolt against Putin by his own army and people. There could be serious financial market chaos from the sanctions, or the losses could be contained. There could be sharp rises in energy prices as the Russian supplies are withdrawn from global markets. Or prices may retreat as the US reopens shale and the Europeans temporarily pull back against their ESG goals.”

We would add to David’s points that the Federal Reserve and other global central banks could stay the course and tighten monetary policy or change course and tighten more slowly or even reverse course.

We think it is important to reiterate that even before the Russian invasion there were headwinds for the stock market that led us to expect a below-average year for market returns with a higher possibility of negative returns than had been the case since the recovery from the Great Financial Crisis began in 2009. Take away Ukraine and the market still faces tightening monetary policy by the Federal Reserve and most global central banks, elevated inflation that looks set to persist for at least several more quarters, slowing GDP growth as stimulus wanes, higher interest rates, and a likely shift in spending from goods to services as the impact from COVID wanes.

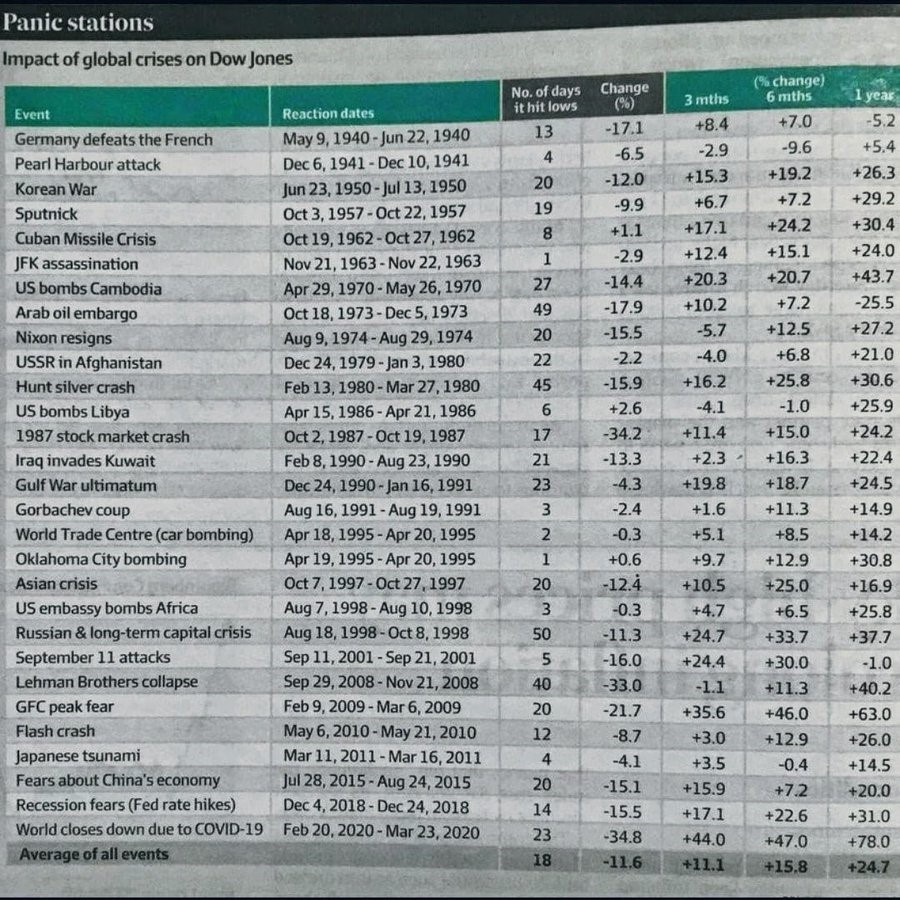

The table below is a summary of market returns during prior crisis periods. It clearly shows that downside comes quickly, averaging just 18 days to the low and lasting no more than 50 days. The downside can be severe, with four instances of over 20% drops, three of which reached over 30%. The average decline is 12%, about how far the S&P 500 has fallen so far in the Ukraine crisis. Importantly, recoveries have been strong and consistent. Looking out 3, 6, or 12 months, there are only 9 instances of negative returns across all time frames in the 29 crisis periods. The rebounds averaged 11%, 16%, and 25%, respectively, 3, 6, and 12 months later.

We are not predicting the recovery will be as good as in past crises or the downturn as short. As we began, the path of the current crisis is impossible to predict. We also reiterate that the same headwinds exist that we outlined in early January. The history of crises does show why investors have been willing to buy the dip so far over the past week.

Northlake has taken no major action in response to the Ukraine crisis. We expect volatility to remain high, but we want to stick to the investment plan for each of our clients for now. As a reminder, we reached out to each of you with an overview of investment strategy in the second half of 2021.