Is Value Finally Going to Provide Persistent Leadership?

The are no changes to Northlake’s favored themes after the June update. For the third consecutive month, we recommend mid cap and value. Client positions following the models will maintain positions in the S&P 400 Mid Cap (MDY) and the Russell 1000 Value (IWD). Clients using thematic strategies but not invested via the models will continue to own ETFs in small and mid cap, value, and sectors that lean value such as financials and industrials.

The most interesting takeaway from our updated models is a second consecutive month with one of the strongest value readings in the 40-year history of the models including since we last made significant changes to the models almost seven years ago. The policy response to the pandemic is the main reason for the strong value readings. We had favored growth or been neutral on growth vs value almost continuously since 2014 until we switched to value. One of the strongest growth readings we had was in March 2020 as the pandemic was beginning but before the policy response was clear. Our growth preference remained in place until the fall although our conviction was receding steadily. In the fall, we moved to neutral before the shift to value this spring.

The fiscal and monetary policy response to the pandemic has been extreme. The Federal Reserve moved short-term interest rates toward 0% and flooded the world with liquidity. Washington lawmakers more than fully replaced lost household incomes with stimulus payments and provided direct relief to many businesses. It took investors awhile to begin shifting to value stocks. This was probably because growth stocks had been leaders for so long in response to the weak recovery from the Great Financial Crisis. When COVID vaccines were approved, value came into favor. Value stocks overlap with reopening plays and also do well during the initial recovery from recessions as commodity prices firm, demand for manufactured goods improves, and companies and households turn to banks for loans. The setup was perfect and value has outperformed growth since the FANG stocks initially peaked in September followed by a peak for speculative growth stocks in February.

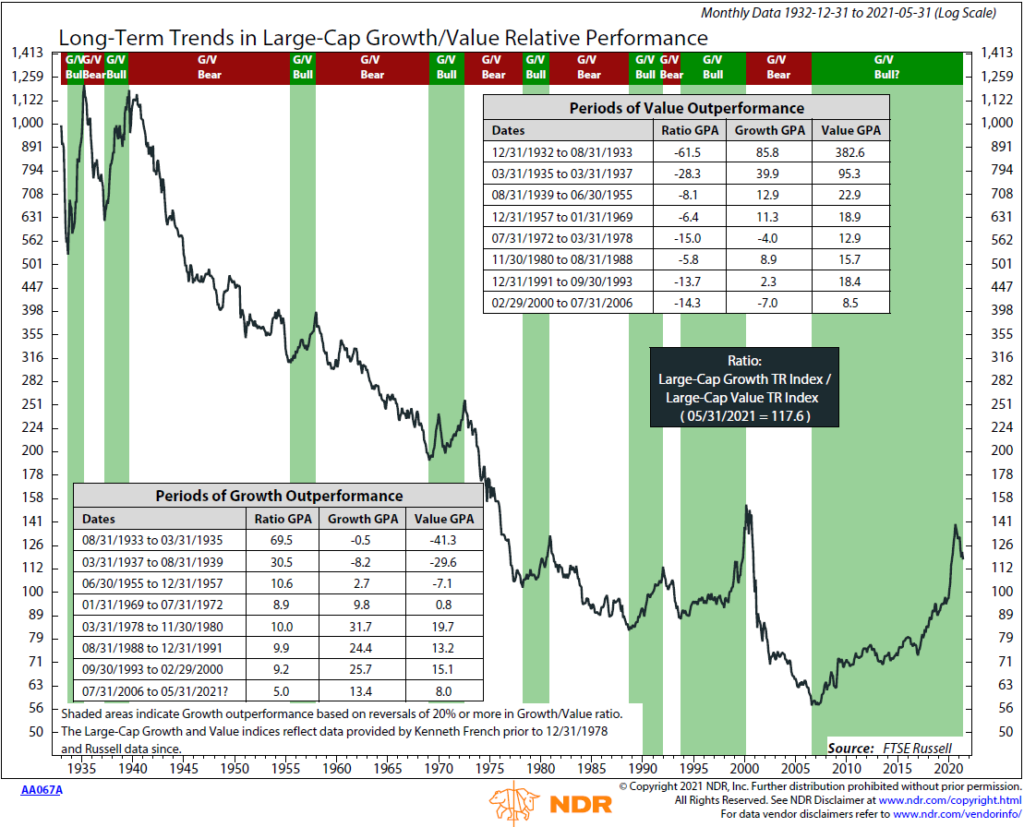

Below is an updated view of the long-term relative performance of growth vs value. The green colored areas are when growth outperforms. The shift to growth coming out of the GFC is clear. There is also a clear shift toward value after the dotcom bubble burst. You can also see the reversal to value over the last several months. Major economic and market events often lead to big changes in investor preferences. Perhaps the pandemic will ultimately be recast to be the start of a new persistent period of value outperforming. For now, that is where Northlake believes the market is headed.

MDY and IWD are widely held by clients of Northlake Capital Management, LLC, including in Steve Birenberg’s personal accounts. Steve is sole proprietor of Northlake, a registered investment advisor. Northlake’s regulatory filings can be found at www.sec.gov.