Northlake Capital Management founder Steve Birenberg has spent his entire 32 year investment management career serving high-net-worth individual investors and managing their related retirement and charitable accounts.

Until the second half of the 1990s, professional investors had an edge due to good analysis and access to sources of information that weren’t widely available to individual investors. However, the bull market in the late 1990s coincided with the rise of the Internet and other advances in communications technology. More information was available to investors, and it flowed faster. Stock prices responded more quickly to news. The decline in trading costs accelerated and ultimately trading costs collapsed. All this led to increased competition. It became easy to set up new money management firms. Individual investors had inexpensive access to tools formally exclusive to the pros. The bull market fueled demand. What happened was obvious: Money managers faced a new environment where traditional methods of beating the market no longer worked. Their edge was gone.Steve felt so strongly about the need to develop new strategies to confront these challenges that in May 2004 he walked away from a sure thing career-wise and formed Northlake Capital Management. In order to address the new environment, Northlake uses a combination of exchange traded funds (ETFs) and individual stocks. We use ETFs to provide broad equity exposure as core holdings for our clients, while other ETFs and carefully researched individual stocks are held with the purpose of seeking incremental excess return to market indices.

Long-only managers, including actively managed mutual funds, traditionally buy a large portfolio of stocks roughly based on the index they have chosen as their benchmark. For high-net-worth individual investors, the benchmark is usually the S&P 500. This means that long-only managers will buy anywhere from 30 to 200 stocks across all 10 S&P sectors. Active managers conduct extensive securities analysis to choose the best stocks in each sector and industry. The research is thorough and the thesis is sound. Yet, active managers have a long history of underperforming the market. We believe this is the case because (1) the risk-reward tradeoff on individual stocks has skewed negatively, (2) long-only managers often lack focus or are too broadly diversified, and (3) the costs to investors of active management are high.

We believe there is a better way to manage funds for long-only investors using a combination of exchange-traded funds and special situation equities. A portfolio of actively managed ETFs provides the same upside as a portfolio of individual stocks but with dramatically reduced security selection risk. With about 200 ETFs currently available covering all styles, sectors, and industries, we believe it is possible to add incremental return through active management of a portfolio of ETFs.

Northlake Capital Management worked closely with Ned Davis Research to adapt some of their capitalization and style models to the ETF universe. We back-tested models to the early 1980s and found encouraging results after including slippage assumptions for commissions and market impact. We have been actively managing client portfolios using these models and the results mirror the success of the back-tests.

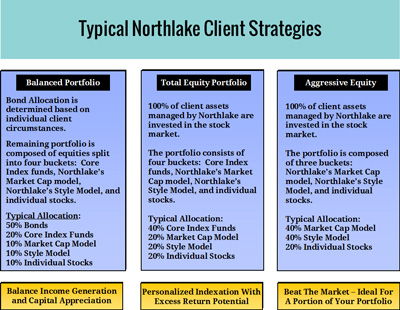

Typically, ETFs driven by the models comprise 60-80% of client equity portfolios. The balance of the equity portfolio is a handful of carefully researched individual stocks from a narrow group of industries. By taking a “narrow but deep” approach to stock selection, Northlake can still maintain an edge relative to the market by focusing on our areas of expertise.

Commentary on the current ETF holdings, Northlake’s models, and research on the individual stocks can be found in Northlake’s Media Talk Blog at www.northlakecapital.com/mediatalk.