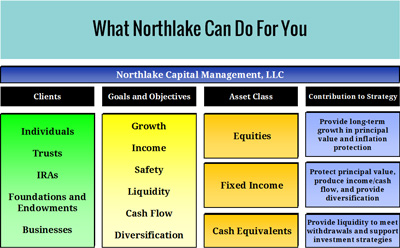

Northlake Capital Management, LLC is a registered investment advisor offering investment advisory services to high net worth individuals and their affiliated entities. Northlake specializes in the management of equity portfolios using exchange traded funds (ETFs) and individual stocks. We build and manage conservative, balanced, or aggressive growth client portfolios depending on individual investment goals and risk tolerance.

Northlake uses ETFs representing common stock indices such as the S&P 500 or the Russell 2000 to provide broad exposure to equity markets. These ETFs are core holdings for many of our clients. We also use customized monthly ETF rotation models we developed in conjunction with Ned Davis Research (NDR) in order to select the best ETFs in Market Capitalization and Style themes. The Market Capitalization Model rotates among small, mid, and large capitalization ETFs. The Style Model rotates among growth and value ETFs. Back-tests of these models show superior returns since 1980. Successful investments for real clients have been achieved since 2004.

When selecting individual stocks, our expertise includes companies in the global media, entertainment, leisure, technology, and telecom industries. Northlake founder Steve Birenberg is an acknowledged expert in these industries, having spent most of his 32 year investment career specializing in these industries. Steve has provided analysis and commentary on media stocks for RealMoney.com, the subscription service of TheStreet.com. Steve’s research has been mentioned several times by Jim Cramer on his CNBC TV show, Mad Money. Steve has also appeared on Fox Business News, and is quoted regularly in The Hollywood Reporter.Upon inception of a new client relationship, Northlake works with clients to create an investment policy statement that defines the investment goals, objectives, and restrictions governing the day-to-day management of the account. Northlake manages client assets on a discretionary basis within the constraints dictated by the investment policy statement. Northlake’s expertise extends to investment grade fixed income securities enabling investors with any return objective or risk tolerance to find a home.

Client accounts are held with a third party financial institution, granting Northlake a limited power of attorney to conduct transactions. Northlake maintains a preferred custody relationship with Charles Schwab allowing clients to obtain extremely low cost custody with very advantageous commission rates on trades. Clients receive a monthly statement from their custodian and a quarterly report from Northlake.

Northlake clients have a unique ability to read real time research and commentary on the investments held in their accounts through the Media Talk Blog at www.northlakecapital.com/mediatalk. Clients and other friends of the firm can respond and interact as regular updates are posted. This unique forum allows clients to gain insights into the how their money is being managed rather than sit back and wait for the monthly or quarterly report.